Distribution of wealth

The distribution of wealth is a comparison of the wealth of various members or groups in a society. It differs from the distribution of income in that it looks at the distribution of ownership of the assets in a society, rather than the current income of members of that society.

Contents |

Definition of wealth

Wealth is a person's net worth, expressed as:

- wealth = assets − liabilities

The word "wealth" is often confused with "income". These two terms describe different but related things. Wealth consists of those items of economic value that an individual owns, while income is an inflow of items of economic value. (See Stock and flow.) The relation between wealth, income, and expenses is:

- change of wealth = income − expense

A common mistake made by people embarking on a research project to determine the distribution of wealth is to use statistical data of income to describe the distribution of wealth. The distribution of income is substantially different from the distribution of wealth. According to the International Association for Research in Income and Wealth, "the world distribution of wealth is much more unequal than that of income."[1]

If an individual has a large income but also large expenses, her or his wealth could be small or even negative.

Statistical distributions

There are many ways in which the distribution of wealth can be analysed. One example is to compare the wealth of the richest ten percent with the wealth of the poorest ten percent. In many societies, the richest ten percent control more than half of the total wealth. Mathematically, a Pareto distribution has often been used to quantify the distribution of wealth, since it models an unequal distribution. More sophisticated models have also been proposed.[2] Generally, income inequality metrics can be used as wealth inequality metrics.

Redistribution of wealth and public policy

In many societies, attempts have been made, through property redistribution, taxation, or regulation, to redistribute wealth, sometimes in support of the upper class, and sometimes to diminish extreme inequality.

Examples of this practice go back at least to the Roman republic in the third century B.C.,[3] when laws were passed limiting the amount of wealth or land that could be owned by any one family. Motivations for such limitations on wealth include the desire for equality of opportunity, a fear that great wealth leads to political corruption, to the belief that limiting wealth will gain the political favor of a voting bloc, or fear that extreme concentration of wealth results in rebellion.[4] Various forms of socialism attempt to diminish the unequal distribution of wealth and thus the conflicts arising from it.

During the Age of Reason, Francis Bacon wrote "Above all things good policy is to be used so that the treasures and monies in a state be not gathered into a few hands... Money is like muck, not good except it be spread."[5]

Communism arose as a reaction to a distribution of wealth in which a few lived in luxury while the masses lived in extreme poverty. In The Communist Manifesto Marx and Engels wrote "From each according to his ability, to each according to his need."[6] While the ideas of Marx have been embraced by various states (Russia and China in the 20th century), Marxism has seldom if ever worked in practice.[7]

On the other hand, the combination of labor movements, technology, and social liberalism has diminished extreme poverty in the developed world today, though extremes of wealth and poverty continue in the Third World.[8]

Charity

In addition to government efforts to redistribute wealth, the tradition of individual charity is a voluntary means of wealth transference. There are also many voluntary charitable organizations making concerted efforts to aid those in need.

21st century

At the end of the 20th century, wealth was concentrated among the G8 and Western industrialized nations, along with several Asian and OPEC nations. An Energy Information Administration report stated that OPEC member nations were projected to earn $1.251 trillion in 2008, from their oil exports, due to the record crude prices.[9]

A study by the World Institute for Development Economics Research at United Nations University reports that the richest 1% of adults alone owned 40% of global assets in the year 2000, and that the richest 10% of adults accounted for 85% of the world total. The bottom half of the world adult population owned 1% of global wealth.[10] Moreover, another study found that the richest 2% own more than half of global household assets.[11]

Real estate

While sizeable numbers of households own no land, few have no income. For example, 10% of land owners (all corporations) in Baltimore, Maryland own 58% of the taxable land value. The bottom 10% of those who own any land own less than 1% of the total land value.[12] This form of Gini coefficient analysis has been used to support Land value taxation.

In the United States

According to the Congressional Budget Office, between 1979 and 2007 incomes of the top 1% of Americans grew by an average of 275%. During the same time period, the 60% of Americans in the middle of the income scale saw their income rise by 40%. Since 1979 the average pre-tax income for the bottom 90% of households has decreased by $900, while that of the top 1% increased by over $700,000, as federal taxation became less progressive. From 1992-2007 the top 400 income earners in the U.S. saw their income increase 392% and their average tax rate reduced by 37%.[13] In 2009, the average income of the top 1% was $960,000 with a minimum income of $343,927.[14][15][16]

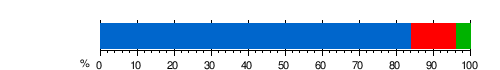

In 2007 the richest 1% of the American population owned 34.6% of the country's total wealth, and the next 19% owned 50.5%. Thus, the top 20% of Americans owned 85% of the country's wealth and the bottom 80% of the population owned 15%. Financial inequality was greater than inequality in total wealth, with the top 1% of the population owning 42.7%, the next 19% of Americans owning 50.3%, and the bottom 80% owning 7%.[17] However, after the Great Recession which started in 2007, the share of total wealth owned by the top 1% of the population grew from 34.6% to 37.1%, and that owned by the top 20% of Americans grew from 85% to 87.7%. The Great Recession also caused a drop of 36.1% in median household wealth but a drop of only 11.1% for the top 1%, further widening the gap between the 1% and the 99%.[17][18][19] During the economic expansion between 2002 and 2007, the income of the top 1% grew 10 times faster than the income of the bottom 90%. In this period 66% of total income gains went to the 1%, who in 2007 had a larger share of total income than at any time since 1928.[20]

Dan Ariely and Michael Norton show in a study (2011) that US citizens across the political spectrum significantly underestimate the current US wealth inequality and would prefer a more egalitarian distribution of wealth, raising questions about ideological disputes over issues like taxation and welfare.[21]

Data, charts, and graphs

- PowerPoint presentation: Inequalities of Development - Lorenz curve and Gini coefficient

- The World Distribution of Household Wealth [10]

- Article on The World Distribution of Household Wealth report.

- The Federal Reserve Board - Survey of Consumer Finances

- Survey of Consumer Finances 1998-2004 charts - pdf

- Survey of Consumer Finances 1998-2004 data

and resulting Gini indices for mean incomes: 1989: 51.1, 1992: 47.8, 1995: 49.0, 1998: 50.4, 2001: 52.6, 2004: 51.4 - Changes in the Distribution of Wealth in the U.S., 1989-2001

- Report on Net Worth and Asset Ownership of Households

- Projections of the Number of Households in the U.S. 1995-2010

- The System of National Accounts (SNA): comparison of U.S. national accounts statistics with those of other countries

- World Trade Organization: Resources

- Champagne Glass infographic of global wealth distribution from Dalton Conley's You May Ask Yourself: An Introduction to Thinking Like a Sociologist textbook which was adapted from the 1992 UNDP original

World distribution of household wealth by region and country

Data for the following table obtained from UNU-WIDER World Distribution of Household Wealth Report (The University of California also hosts a copy of the report)

Table

| Region | Percent of world population | Percent of world net worth (PPP) | Percent of world net worth (exchange rates) | Percent of world GDP (PPP) | Percent of world GDP (exchange rates) |

| North America | 5.17 | 27.1 | 34.39 | 23.88 | 33.67 |

| Central/South America | 8.52 | 6.51 | 4.34 | 8.49 | 6.44 |

| Europe | 9.62 | 26.42 | 29.19 | 22.8 | 32.4 |

| Africa | 10.66 | 1.52 | 0.54 | 2.36 | 1.01 |

| Middle East | 9.88 | 5.07 | 3.13 | 5.69 | 4.1 |

| Asia | 52.18 | 29.4 | 25.61 | 31.07 | 24.1 |

| Other | 3.14 | 3.7 | 2.56 | 5.4 | 3.38 |

World distribution of financial wealth

In 2007, 147 companies controlled nearly 40 percent of the monetary value of all transnational corporations.[22]

See also

- Distribution (economics)

- Generational accounting

- List of countries by distribution of wealth

- List of countries by income equality

- Redistribution (economics)

- Redistribution of wealth

- Wealth condensation

- Kinetic exchange models of markets

References

- ^ http://www.iariw.org/abstracts/2006/daviesa.pdf

- ^ "Why it is hard to share the wealth"

- ^ Livy, Rome and Italy: Books VI-X of the History of Rome from its Foundation, Penguin Classics, ISBN 0-14-044388-6

- ^ "... A perceived sense of inequity is a common ingredient of rebellion in societies ...", Amartya Sen, 1973

- ^ Francis Bacon, Of Seditions and Troubles

- ^ Karl Marx and Frederick Engels, The Communist Manifesto, Filiquarian, 2007, ISBN13: 978-1599869957

- ^ Archie Brown, The Rise and Fall of Communism, Ecco, 2009, ISBN 9780061138799

- ^ Jeffrey D. Sachs, The End of Poverty, Penguin, 2006, ISBN 978-0143036586

- ^ OPEC to earn $1.251 trillion from oil exports - EIA, Reuters

- ^ a b The World Distribution of Household Wealth. James B. Davies, Susanna Sandstrom, Anthony Shorrocks, and Edward N. Wolff. 5 December 2006.

- Launch of the WIDER study on The World Distribution of Household Wealth (includes press release, summary, and data)

- Estimating the Level and Distribution of Global Household Wealth (copy of full report with a cover page added)

- The World Distribution of Household Wealth (exact copy of report published at United Nations website)

- ^ The rich really do own the world 5 December 2006

- ^ Kromkowski, "Who owns Baltimore", CSE/HGFA, 2007.

- ^ It's the Inequality, Stupid By Dave Gilson and Carolyn Perot in Mother Jones, March/April 2011 Issue

- ^ Who are the 1 percent?, CNN, October 29, 2011

- ^ "Tax Data Show Richest 1 Percent Took a Hit in 2008, But Income Remained Highly Concentrated at the Top." Center on Budget and Policy Priorities. Accessed October 2011.

- ^ Top Earners Doubled Share of Nation’s Income, Study Finds New York Times By Robert Pear, October 25, 2011

- ^ a b Occupy Wall Street And The Rhetoric of Equality Forbes November 1, 2011 by Deborah L. Jacobs

- ^ Recent Trends in Household Wealth in the United States: Rising Debt and the Middle-Class Squeeze—an Update to 2007 by Edward N. Wolff, Levy Economics Institute of Bard College, March 2010

- ^ Wealth, Income, and Power by G. William Domhoff of the UC-Santa Barbara Sociology Department

- ^ Cite error: Invalid

<ref>tag; no text was provided for refs namedautogenerated1; see Help:Cite errors/Cite error references no text - ^ Norton, M. I., & Ariely, D., "Building a Better America – One Wealth Quintile at a Time", Perspectives on Psychological Science, January 2011 6: 9-12

- ^ Financial world dominated by a few deep pockets. By Rachel Ehrenberg. September 24, 2011; Vol.180 #7 (p. 13). Science News. Citation is in the right sidebar. Paper is here with PDF here.